Assured

Founded Year

2019Stage

Series A | AliveTotal Raised

$40KValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+48 points in the past 30 days

About Assured

Assured is a company that provides SaaS solutions for the property and casualty insurance industry. Its main offerings include a Claims Intelligence Platform that enables the digital ingestion, servicing, and processing of insurance claims. The platform supports various lines of business such as personal auto, commercial auto, homeowners, commercial property, and workers' compensation. It was founded in 2019 and is based in Palo Alto, California.

Loading...

ESPs containing Assured

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The customer claim reporting market provides software that enables policyholders to submit claims to their insurance company. These solutions typically include self-service portals as well as back-end systems that companies can use to process and track those claims. The providers in this space have the potential to help insurers automate customer service operations and improve processing times for…

Assured named as Challenger among 10 other companies, including Newgen, CCC Intelligent Solutions, and Snapsheet.

Loading...

Research containing Assured

Get data-driven expert analysis from the CB Insights Intelligence Unit.

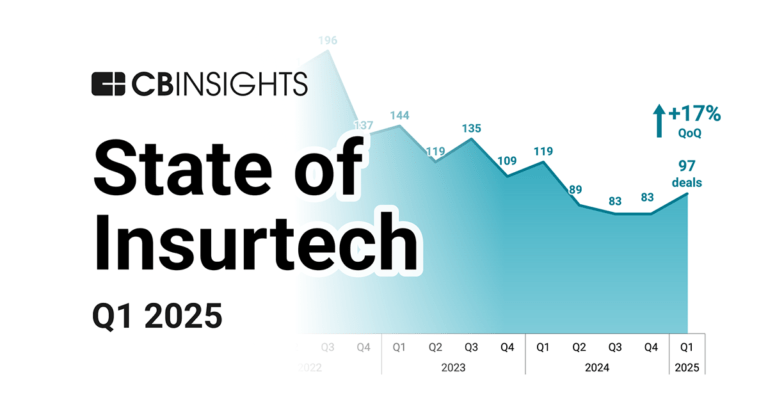

CB Insights Intelligence Analysts have mentioned Assured in 1 CB Insights research brief, most recently on May 8, 2025.

May 8, 2025 report

State of Insurtech Q1’25 ReportExpert Collections containing Assured

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Assured is included in 4 Expert Collections, including Insurtech.

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Unicorns- Billion Dollar Startups

1,276 items

Artificial Intelligence

10,047 items

Assured Patents

Assured has filed 25 patents.

The 3 most popular patent topics include:

- life insurance

- insurance

- insurance fraud

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/1/2024 | 1/28/2025 | Graphical projections, Roadsters, Light machine guns, Cephalopod zootomy, Cuttlefish | Grant |

Application Date | 7/1/2024 |

|---|---|

Grant Date | 1/28/2025 |

Title | |

Related Topics | Graphical projections, Roadsters, Light machine guns, Cephalopod zootomy, Cuttlefish |

Status | Grant |

Latest Assured News

Apr 25, 2025

CB Insights Q1: Fintech Funding Rebounds, Driven by the AI and Digital Asset Verticals AI companies represent an increasing share of fintech deals, digital asset startups are leading early-stage investments, and digital banking ventures are showing the strongest growth potential across the whole fintech industry. Get the hottest Fintech Switzerland News once a month in your Inbox Fintech funding is witnessing a resurgence this year, fueled by large rounds of funding going towards late-stage ventures, according to a new data from CB Insights. Artificial intelligence (AI), digital assets and digital banking are among the most active verticals, marked by increased deal activity, significant capital inflows, and strong growth potential Fintech funding rebounds Fintech investment made a comeback in Q1 2025, with companies in the sector raising a total of US$10.3 billion. The sum marks an 18% quarter-over-quarter (QoQ) increase, and the first time in two years that fintech funding surpassed the US$10 billion threshold. This growth was driven by larger, late-stage rounds, most notably the landmark US$2 billion deal secured in March by Binance from MGX, an Abu Dhabi-based AI and advanced technology investor. The transaction marked Binance’s first institutional funding round and set records as both the largest-ever investment in a crypto company and the biggest transaction paid entirely in a stablecoin. Global quarterly fintech funding, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 Mega-rounds drive growth Fintech funding activity in Q1 2025 was led by mega-rounds worth US$100 million and over. These transactions secured a total of US$4.5 billion through 14 deals during the quarter, representing a significant increase from US$1.8 billion and 11 mega-rounds during the same period in 2024. Quarterly funding and deals from mega-rounds, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 This inflow in capital pushed the median deal size to US$4.1 million in 2025 year-to-date (YTD), up 5.1% from US$3.9 million in 2024. Despite the growth in deal value, total deal volume slipped 3% QoQ to 777 transactions, marking a fourth straight quarterly decline. Investor appetite for early-stage rounds also waned, with these deals making up a smaller share of funding activity by accounting for 67% of fintech deals in 2025 YTD, down 8 points from 72% in 2024. Annual percent of deals by deal stage, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 AI in fintech draws increased investor interest In Q1 2025, AI companies continued to attract investors’ interest, capturing a larger share of all fintech dealmaking. During the quarter, AI companies targeting fintech closed a total of 122 rounds, representing 15.7% of all fintech deals. The figure marks a new all-time high for the sector, and is more than double their share during Q4 2022 when OpenAI launched ChatGPT. AI companies’ share of fintech funding also ticked up in Q1 2025, rising to 17%. Quarterly share of fintech deals going to AI companies, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 The biggest deal to an AI-powered fintech company in Q1 2025 was secured by Figure, an alternative lending closed a US$200 million round in February. Founded in 2018 by former SoFi CEO Mike Cagney, Figure offers automated home improvement, business, and debt consolidation loans, and which allows cryptocurrency investors to use digital assets as loan collateral. The startup servs over 100,000 households in 47 American states. Digital assets lead early-stage deals Digital asset was another prominent fintech vertical in Q1 2025, with more than half of the top seed and Series A deals secured during the Q1 2025 going towards companies developing crypto, blockchain, and digital asset solutions. Share of digital asset companies among top early-stage deals in Q1 2025, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 Later-stage activity was also robust. Among the ten biggest fintech deals, three went to crypto and blockchain companies: Binance, Phantom and ZenMEV. Phantom, a crypto wallet focused on the Solana blockchain, raised a US$150 million Series C in January at a US$3 billion valuation. The round was co-led by Sequoia Capital and Paradigm, with participation from existing investors including a16z crypto and Variant. ZenMEV, a blockchain platform designed to democratize access to maximal extractable value (MEV), secured a US$140 million investment in March. The capital came from VC VentureX, a VC firm specializing in Web3 and decentralized finance (DeFi). Another milestone in the digital asset space came with Sygnum’s rise to unicorn status. The digital asset bank completed in January 2025 an oversubscribed US$58 million round, achieving a post-money valuation of more than US$1 billion. Sygnum provides regulated banking, asset management, and tokenization services for cryptocurrencies and blockchain-based assets. It serves professional and institutional investors, banks, corporates and distributed ledger technology (DLT) foundations. In addition to Sygnum, two other fintech startups reached unicorn startups in Q1 2025: Plata, a Mexican startup offerings credit cards, cashback, and buy now, pay later (BNPL) services, which raised a US$160 million Series A round in March and which is now valued at US$1.5 billion; and Assured Insurance Technologies, an insurtech company providing insurance carriers with white-label software-as-a-service (SaaS) solutions, which raised an undisclosed growth-stage funding in March, valuing the company at US$1 billion. Top fintech equity deals in Q1 2025, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 Digital banking shows resilience Though digital banking companies witnessed a decline in both funding value and volume in Q1 2025, the sector showed resilience. Among all major fintech verticals, the category now has the highest average CB Insights Mosaic score at 559, ahead of AI in fintech (512), and payments (481). CB Insights Mosaic score measures the health and growth potential of private tech companies on a 0-1,000 scale. Average mosaic score out of 1,000 as of March 31, 2025 by fintech vertical, Source: State of Fintech Q1 2025, CB Insights, Apr 2025 Mercury is a San Francisco-based fintech company providing banking, credit cards, and financial software; Varo is a US-based, fully digital bank that offers no-fee banking services, including checking, savings, and early direct deposit, through a mobile app; and Moniepoint, based in Nigeria, provides banking and payment services to small and medium-sized enterprises (SMEs), aiming to bridge the financial services gap for small businesses.

Assured Frequently Asked Questions (FAQ)

When was Assured founded?

Assured was founded in 2019.

Where is Assured's headquarters?

Assured's headquarters is located at 650 Page Mill Road, Palo Alto.

What is Assured's latest funding round?

Assured's latest funding round is Series A.

How much did Assured raise?

Assured raised a total of $40K.

Who are the investors of Assured?

Investors of Assured include Kleiner Perkins, ICONIQ Capital, Global Founders Capital, Henry Kravis, Neo and 7 more.

Who are Assured's competitors?

Competitors of Assured include Vouch and 5 more.

Loading...

Compare Assured to Competitors

Unqork focuses on providing a codeless application development platform for the enterprise sector. Its main offerings include a visual designer for creating complex, mission-critical enterprise applications without the need for traditional coding. The company primarily serves sectors such as financial services, insurance, government, and healthcare. It was founded in 2017 and is based in New York, New York.

AntWorks specializes in the intelligent document processing sector. The company offers a platform, CMR+, that processes a wide range of documents in various formats, including forms, handwritten notes, images, tables, and signatures, to streamline operations and enhance data-driven decision-making. AntWorks primarily serves sectors such as banking, financial services, insurance, manufacturing, retail, and supply chain. It was founded in 2015 and is based in Singapore.

Hyperscience focuses on enterprise artificial intelligence (AI) infrastructure and hyperautomation within the technology sector. The company provides solutions that automate and orchestrate business processes, aiming to improve manual operations. Hyperscience's services address back office data and documents, impacting decision-making and productivity across various sectors. It was founded in 2014 and is based in New York, New York.

Joyn Insurance focuses on underwriting commercial insurance in the small and middle market sectors. The company offers general liability and property insurance, using technology, data, and expertise to deliver a transparent and efficient insurance experience. Joyn Insurance primarily serves sectors such as real estate, manufacturing, services, wholesale, retail, and artisan contractors. It was founded in 2020 and is based in Sacramento, California.

Coverdash is a digital business insurance agency that specializes in providing tailored insurance solutions for various business sectors. The company offers a range of products, including general liability, business owner's policies, workers' compensation, cyber, professional, and management liability insurance. Coverdash primarily serves small businesses, startups, e-commerce merchants, and freelancers. It was founded in 2022 and is based in New York, New York.

Embroker offers digital insurance brokerage specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. It primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Loading...