Aspire

Founded Year

2018Stage

Series C | AliveTotal Raised

$300.18MLast Raised

$100M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-1 points in the past 30 days

About Aspire

Aspire develops a full-stack operating financial operation system. It enables accounting, payment, lending, expense management, and more. It provides business credit lines to help solve their working capital needs. It offers users access to funding and financial tools to manage bank accounts, credit cards, invoicing, and expenses, among others. The company was founded in 2018 and is based in Singapore.

Loading...

Aspire's Products & Differentiators

Incorporation

Simple and 100% digital incorporation

Loading...

Research containing Aspire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Aspire in 2 CB Insights research briefs, most recently on Mar 29, 2024.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Aspire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Aspire is included in 5 Expert Collections, including Digital Lending.

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Fintech

13,978 items

Excludes US-based companies

Fintech 100

200 items

Fintech 100 (2024)

100 items

Latest Aspire News

Jun 12, 2025

Tech Collective Software as a service (or SaaS) is no longer just a buzzword in Southeast Asia. In fact, since it began gaining traction in the early 2010s , it has quickly become a core driver of business innovation and growth by streamlining operations, reducing overhead, and enabling companies to scale faster and more efficiently than ever before. From managing dispersed teams and automating repetitive tasks, to protecting data and even optimising creative processes, SaaS is quietly powering the day-to-day functions of startups, SMEs and even global enterprises . This can be attributed to the rise of remote and hybrid work, increasingly tech-savvy users and a rapid spike in digital adoption. In 2025, five standout players — Lark, Aspire, Acronis, BandLab, and EngageRocket — are doing more than just keeping pace with the region’s SaaS boom. They’re shaping how businesses communicate, manage, create, and grow across borders. With distinct approaches to product design, market fit, and regional scaling, these companies are ones to watch as Southeast Asia’s digital economy evolves. 1. Lark A collaboration platform by ByteDance, Lark has evolved far beyond a basic messaging or video conferencing tool. It integrates chat, video calls, cloud storage, calendar, and collaborative docs into one seamless ecosystem — and it’s tailor-made for distributed teams. What makes Lark stand out in Southeast Asia is its focus on real-time productivity without requiring users to juggle multiple apps. As businesses across the region lean into hybrid work, Lark’s appeal lies in its flexibility and localisation. Its multilingual interface and smooth mobile experience resonate particularly well with younger, mobile-first teams. In markets like Indonesia and Vietnam, where bandwidth and infrastructure can be inconsistent, Lark’s lightweight design and cloud-first architecture have made it a go-to for fast-growing startups and education providers alike. 2. Aspire Singapore-based Aspire is reshaping how small and medium businesses manage their finances. Think of it as a neobank for startups — offering business accounts, corporate cards, expense tracking, and multi-currency management, all within a single platform. Aspire’s sweet spot lies in addressing pain points many SMEs face in Southeast Asia: fragmented banking systems, opaque fee structures, and slow approvals. By combining fintech with SaaS principles, Aspire offers real-time insights and spend controls that traditional banks can’t match. The platform’s recent integration with accounting tools like Xero and QuickBooks has further cemented its role as a financial command centre for digital-native businesses. In countries where financial inclusion is still a work in progress, Aspire is helping to bridge that gap with speed and simplicity. 3. Acronis The Singapore-born company is one of Southeast Asia’s most globally recognised SaaS powerhouses, championing cybersecurity and data protection. Dubbed as the “ultimate SaaS platform”, Acronis has cemented its presence across Southeast Asia through scalable and easy-to-use data protection-as-a-service. At a time when cyber threats are surging and data privacy is a pressing concern, Acronis has garnered a loyal following among businesses that desire peace of mind without staffing huge I.T. teams. Its power rests on the fact that it incorporates cybersecurity, backup, DR and endpoint protection all in one platform. Acronis is a trusted partner for MSPs (Managed Service Providers) and regional enterprises alike. Acronis offers an all-in-one solution that enables them to provide secure digital infrastructure to their clients – a critical capability second to none in a highly regulated environment such as finance, insurance, health care etc. Acronis is behind the scenes, keeping the region’s digital operations secure with AI-powered threat detection and compliance-ready systems. 4. BandLab BandLab may not be a typical SaaS platform, but it fits squarely within the category with its cloud-based approach to music creation. Based in Singapore, BandLab lets users record, edit, mix, and collaborate on music — all from a browser or mobile app. No studio, expensive software, or gear required. What sets BandLab apart is how it blends creative tools with a built-in social platform. Users can access royalty-free samples, mastering tools, and live collaboration features — making it easy for musicians to work together from anywhere. In Southeast Asia, where access to high-end creative software is still limited, BandLab gives emerging creators a way to produce and share their work professionally and affordably. With over 60 million users worldwide, BandLab shows how a Southeast Asian company can create a global platform by focusing on accessibility, usability, and creative freedom. It’s a strong example of how SaaS is expanding beyond business functions into cultural and creative spaces. 5. EngageRocket Employee experience is becoming a bigger focus for companies across Southeast Asia, and EngageRocket is one of the platforms helping to drive that shift. Headquartered in Singapore, the company offers tools that help organisations collect real-time feedback from their teams, track engagement trends, and make more informed HR decisions. What makes EngageRocket stand out is its focus on turning feedback into action. Instead of relying on annual surveys or gut feel, HR teams can use the platform to spot issues early — whether it’s declining morale, communication gaps, or signs of burnout. As the way we work keeps changing, especially with the rise of hybrid setups, EngageRocket gives businesses a clearer picture of how their people are really doing — and what they can do to support them better. Looking ahead SaaS in Southeast Asia isn’t just growing, it’s evolving. What we’re seeing with companies like Lark, Aspire, Acronis, BandLab, and EngageRocket is that success in this space isn’t just about building good software, but about understanding how people work, collaborate, create, and design tools that fit into those habits. From communication and finance to cybersecurity, creativity, and employee well-being, these platforms are helping businesses do more with less, and scale in smarter ways. What makes them worth watching isn’t just their tech — it’s how they’ve tailored that tech to meet real needs across a diverse and fast-changing region. As the digital economy in Southeast Asia continues to mature, the next wave of standout SaaS companies may not look like the ones that came before. But if these five are any indication, the future is going to be local, user-first, and built for impact. Share this:

Aspire Frequently Asked Questions (FAQ)

When was Aspire founded?

Aspire was founded in 2018.

What is Aspire's latest funding round?

Aspire's latest funding round is Series C.

How much did Aspire raise?

Aspire raised a total of $300.18M.

Who are the investors of Aspire?

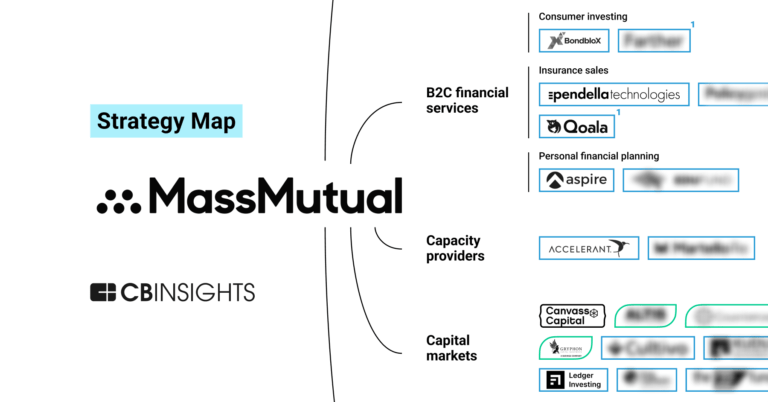

Investors of Aspire include MassMutual Ventures, Picus Capital, LGT Capital Partners, Peak XV Partners, PayPal Ventures and 25 more.

Who are Aspire's competitors?

Competitors of Aspire include Funding Societies and 4 more.

What products does Aspire offer?

Aspire's products include Incorporation and 4 more.

Loading...

Compare Aspire to Competitors

RABC is a high-tech enterprise specializing in R&D, production, manufacturing, sales, and service of various solid-state power lithium batteries.

CrediLinq develops a credit lending platform powered by its proprietary artificial intelligence and machine learning algorithms. It aims to create a digital platform for businesses to get quicker access to growth capital. It primarily caters to the e-commerce industry, providing tools for both buyers and sellers. It was founded in 2021 and is based in Singapore.

Boost is a financial technology company that offers a spectrum of digital financial services across various sectors. The company provides an application for personal finance management, business financing, and enterprise payment solutions. Boost primarily serves the e-commerce industry and small and medium businesses and aims to expand its footprint in the digital banking sector. It was founded in 2017 and is based in Kuala Lumpur, Malaysia.

Behalf provides sales and cash flow solutions within the B2B payments sector. The company offers a solution that allows merchants to provide their business customers with net terms and financing options, thereby enabling purchasing power and payment flexibility. Behalf's services are designed to integrate into eCommerce platforms, automating the payment process across various B2B sales channels, including invoicing and managed sales. It was founded in 2012 and is based in New York, New York.

C2FO is a working capital platform that provides businesses with access to capital. It offers a range of working capital solutions, including early payment programs, cash flow optimization tools, and advisory services, facilitated through its Name Your Rate technology. It primarily serves businesses looking to manage cash flow and enhance financial metrics. It was formerly known as Pollenware. It was founded in 2008 and is based in Leawood, Kansas.

Bluevine is a financial technology company that specializes in providing business banking solutions. The company offers business checking accounts with high-yield interest, accounts payable automation, and extensive FDIC insurance, as well as business loans and credit cards designed to meet the needs of small businesses. Bluevine primarily serves the small business sector with its suite of financial products. It was founded in 2013 and is based in Jersey City, New Jersey.

Loading...