Amount

Founded Year

2014Stage

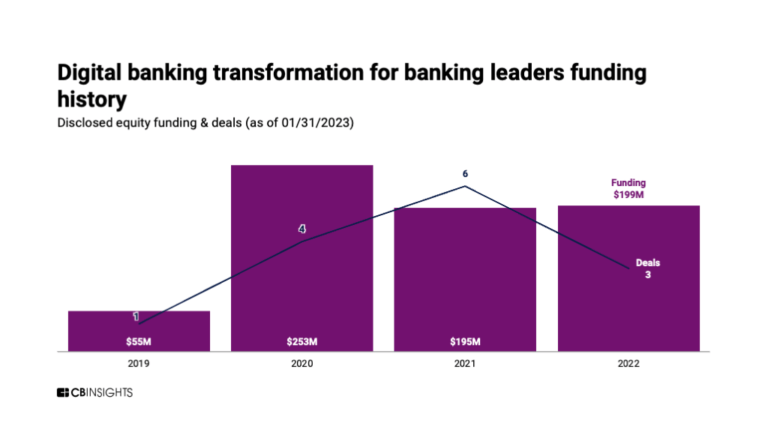

Series E | AliveTotal Raised

$253.2MLast Raised

$30M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+92 points in the past 30 days

About Amount

Amount specializes in digital origination and decisioning within the financial technology sector. The company offers a platform that facilitates account origination for lenders, integrating decisioning for credit, fraud, and compliance, as well as customer journeys to support the lending process. Amount primarily serves regional and community banks, large commercial banks, and credit unions, providing them with tools for their operations. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing Amount

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Loan origination solutions streamline and automate loan application processing for financial institutions. This includes platforms and tools for document analysis, data extraction, underwriting automation, and communication management between parties in the lending workflow. The solutions aim to reduce costs, increase efficiency, and improve the borrower experience while helping financial institut…

Amount named as Challenger among 15 other companies, including Fiserv, nCino, and Wipro.

Amount's Products & Differentiators

Retail Banking

Amount empowers financial institutions to rapidly and securely create high-value digital solutions so customers can bank when, where and how they want. Amount’s fully integrated and flexible platform is underpinned by enterprise bank-grade infrastructure and compliance, ensuring safe and reliable banking experiences across e-commerce and brick-and-mortar channels. Amount technology delivers: Ø White-label application to tailor and optimize cross-channel consumer experiences. Ø API toolkit that enables seamless integrations to originate and manage loans. Ø Proprietary decisioning engine and fraud prevention framework that delivers instant customer approvals and greater conversions without increasing overall risk. Ø Flexible reporting and analytics tools Ø Solutions that work and thrive with existing infrastructure

Loading...

Research containing Amount

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amount in 6 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

The SMB fintech market map

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Amount

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amount is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Digital Lending

2,858 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,124 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Amount Patents

Amount has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/14/2015 | 9/13/2016 | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers | Grant |

Application Date | 10/14/2015 |

|---|---|

Grant Date | 9/13/2016 |

Title | |

Related Topics | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers |

Status | Grant |

Latest Amount News

Jun 23, 2025

Too Long; Didn't Read Banks face rising cyber threats as digital banking grows. To stay secure, they must combine AI, employee training, strong infrastructure, and ongoing audits. Company Mentioned In January 2021, I contributed an article to the Amount blog, a platform dedicated to fintech innovation and banking security, titled “Banks Against Cyber Attacks.” The piece examined the escalating threat landscape facing financial institutions as digital banking accelerated, highlighting the critical importance of robust cybersecurity practices, the adoption of advanced technology, and a culture of security awareness. My article emphasized the importance of proactive risk management, regulatory compliance, and ongoing employee education in protecting sensitive financial data in an increasingly interconnected world. Although the original post has since been removed from the Amount website following my transition from the company, its insights remain relevant in today’s rapidly evolving digital environment. I am proud to have contributed to this important conversation and to have helped raise awareness about the vital role of cybersecurity in fintech and banking. Note: An archived version of my article can be found on the Internet Archive . It’s the age of cloud banking. Bank products and services have become widely accessible over the internet out of necessity. These innovations have enabled efficiencies in our day-to-day lives, while also heightening the risks of cyberattacks. Why are cyber attacks dangerous to financial institutions? Cyber attacks are digital assaults against computers, networks, and/or databases. They can be used to disable computers remotely, steal data, or hack a system’s operations, among other things. Banks are particularly susceptible to cyber attacks. According to research from the Boston Consulting Group, financial institutions are 300 times more likely to suffer from cyber attacks than organizations from other sectors. This underscores the importance of prioritizing a strategy, both defensively and offensively, that combats the risks of modern banking and finance. While cyber threats have been looming for decades now, the global pandemic has further worsened the potential damage in the financial sector. With the shift from cash payments to online alternatives, cybercriminals are given more avenues to execute their attacks. In the past few years, the surging e-commerce space has created new opportunities for both consumers and cybercriminals. Unfortunately, the net result is an ongoing rise in compromised data and stolen money. With cybercriminals becoming more sophisticated in their tactics, banks must improve their cybersecurity measures to ensure that their digital systems are not vulnerable to attacks. What can banks do to protect themselves? Some financial institutions have begun taking appropriate measures to protect their digital assets. Darren Argyle, Chief Information Security Risk Officer at Standard Chartered Bank, places an emphasis on creating application programming interfaces (APIs) with tight verification and authentication processes in place. It’s important to learn how cybercriminals operate so that the institution can put the appropriate security measures in place. The banks’ Information Security teams conduct red/blue teaming exercises to simulate how their security measures hold up against cyber attacks. Through these practices, the team can assess how effective the security system is and pinpoint any weaknesses in its structure. Of course, designing secure systems and then conducting red-teaming exercises are not the only way to protect digital assets. Let’s take a closer look at how banks can safeguard against cyber threats. Find the weak points Coordinate with the IT department and take a deep dive into the system’s applications and databases. Find out all the information that can be used by hackers to execute cyber attacks against the bank or its clients. Don’t enact security measures without assessing the current system first. Identify the weak spots prior to making any strategic decisions. Banks and financial institutions conduct repeat audits to ensure these gaps are filled and to pinpoint new gaps, many times through third-party providers to ensure the most current protocols. Given the complexities of banking and cyber regulations, many banks simply do not have the people power to ensure this type of oversight. Enter artificial intelligence and machine learning. Make use of artificial intelligence (AI) and machine learning (ML) systems Business email compromise via phishing emails are the most common cyber threat for financial institutions. Old tactics like email flooding, spear-phishing, and malware have made a strong comeback in recent times. This can be attributed to services on the dark web that have enabled these methods of attack with little effort and resources. The black market enables attackers of all skill levels to carry out complex attacks. Personalized emails to employees require a simple cross-referencing of social media resources, breaking down the organizational security barriers. Incorporating AI and ML into the bank’s digital system can help in detecting fraudulent emails and even tracking phishing sources. With machine learning in place, a security system will be able to adapt much quicker than any person, making it an effective measure against fraud. In the future, AI and ML systems will be widely implemented to guard against more cyber threats so it’s crucial for financial institutions to establish these systems early. Focus on security fundamentals and avoid common mistakes As the threat landscape broadens, adversaries are growing more sophisticated and crafting more complex attacks to cause even greater damage. Navigating through the complex threat landscape can be challenging. It can be tempting to fall victim to a new shiny tool that assures protection against threats to the organization, but that is not necessarily the case. Many times the most widespread cybersecurity breaches emerge from a lack of security basics done right. The following are key areas where organizational mistakes frequently occur: Security basics Environmental vulnerabilities Neglecting to patch vulnerabilities in a timely manner leaves financial institutions susceptible to attacks. Vulnerabilities are not only limited to bugs, but also include misconfigurations. In-depth defense practices Continuing to identify, apply and enhance security controls while accepting that the technical landscape will change over time will ensure best practices from a defensive standpoint. Educate all employees on cyber threats, not just the IT department In 2021, cybersecurity is no longer just a role for the IT team or the security team. It’s paramount for organizations to educate every employee, partner, client, and customer on the dangers of cyber threats. Employees need to be aware of basic security measures that must be practiced when handling banking processes—be it online or through traditional means. It should not end there. Given the current cyber threat landscape, attacks against banks are not a matter of if, but when. It is one of the top concerns for the financial industry. Banking professionals are encouraged to take the necessary measures to protect their systems against hackers. And they need to realize that doing so is the job of both the employees and the clients. Choose the right partners and vendors While having the right processes, professionals and educational plans in place is important to fight against the ongoing cybersecurity battle, banks need to have a strong platform at their core in order to protect their digital assets and customers. While banks can certainly build their own platforms, FinTechs have become a viable—and quick—option for banks looking to go digital and elevate their fraud and verification capabilities. Amount provides the essential technology banks need to best protect their customers and their information. With core platform features including fraud prevention, verification, decisioning engines and account management, banks have the ability to serve and protect their customers every step of the way. Learn more about how you can upgrade your bank’s infrastructure. L O A D I N G . . . comments & more!

Amount Frequently Asked Questions (FAQ)

When was Amount founded?

Amount was founded in 2014.

Where is Amount's headquarters?

Amount's headquarters is located at 222 North LaSalle Street, Chicago.

What is Amount's latest funding round?

Amount's latest funding round is Series E.

How much did Amount raise?

Amount raised a total of $253.2M.

Who are the investors of Amount?

Investors of Amount include Hanaco Ventures, Goldman Sachs, QED Investors, WestCap, Curql and 11 more.

Who are Amount's competitors?

Competitors of Amount include equipifi, Figure, Lendflow, Dinie, MoneyView and 7 more.

What products does Amount offer?

Amount's products include Retail Banking and 1 more.

Loading...

Compare Amount to Competitors

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Best Egg operates as a consumer financial technology platform in the fintech sector. The company offers a digital financial platform that provides personal loans, credit cards, and financial health resources to help individuals manage their everyday finances. It primarily serves the personal finance management sector. Best Egg was formerly known as Marlette Holdings. It was founded in 2014 and is based in Wilmington, Delaware.

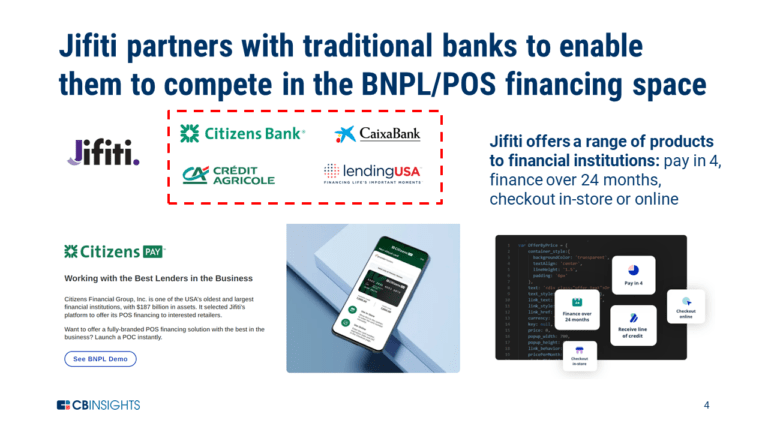

Jifiti provides embedded lending solutions within the financial services sector. The company has a platform that allows banks, lenders, and merchants to offer consumer and business financing options at points of sale, including online, in-store, and via call centers. Jifiti's platform includes financing options such as installment loans, lines of credit, split payments, and Buy Now, Pay Later services for B2C and B2B customers. It was founded in 2011 and is based in Columbus, Ohio.

Zirtue is a company that operates in the financial technology sector, focusing on relationship-based lending. It provides a platform for individuals to lend and borrow money from friends and family, facilitating loan requests and automated repayments, while offering a framework for managing personal loans. Zirtue serves the personal finance sector by allowing lending without traditional banks or predatory lenders. It was founded in 2018 and is based in Dallas, Texas.

Conductiv is a technology company focusing on lending operations within the financial services sector. The company offers a platform for digital data collection, lending guidance based on AI, and loan approvals to facilitate the lending process. Conductiv serves banks and credit unions, to address manual work, fraud, and lending times. It was founded in 2019 and is based in Long Island City, New York.

ChargeAfter provides embedded consumer finance solutions within the financial services industry. The company offers a multi-lender platform for point-of-sale financing that allows merchants to offer financing options to customers online and in-store. ChargeAfter's services include a matching engine for lenders, a platform for managing compliance and underwriting, and tools for post-sale management and analytics. It was founded in 2017 and is based in New York, New York.

Loading...