AlphaSense

Founded Year

2011Stage

Biz Plan Competition | AliveTotal Raised

$1.397BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+47 points in the past 30 days

About AlphaSense

AlphaSense is a market intelligence and search platform that uses artificial intelligence (AI) and natural language processing (NLP) technology to provide insights across various sectors. The company offers tools for financial research, including access to equity research, expert call transcripts, and the ability to integrate and analyze internal content alongside public data. AlphaSense serves the financial services, asset management, consulting, and corporate sectors with its market intelligence solutions. It was founded in 2011 and is based in New York, New York.

Loading...

ESPs containing AlphaSense

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI investment intelligence platforms market develops AI-powered solutions that assist investors in research, analysis, and decision-making. These platforms leverage generative AI, copilots, machine learning, and advanced algorithms to analyze financial data, generate investment insights, predict market movements, and provide personalized investment strategies. By automating research processes …

AlphaSense named as Leader among 15 other companies, including Bloomberg, S&P Global, and Public.

AlphaSense's Products & Differentiators

AlphaSense Core Search (newest release: AlphaSense X)

AlphaSense is the leading market intelligence platform leveraging cutting-edge technology to continuously filter and analyze billions of fragmented pieces of information. We apply the power of AI to an extensive library of high value unstructured and structured data-sets, enabling business professionals to make critical decisions with confidence.

Loading...

Research containing AlphaSense

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AlphaSense in 6 CB Insights research briefs, most recently on Oct 15, 2024.

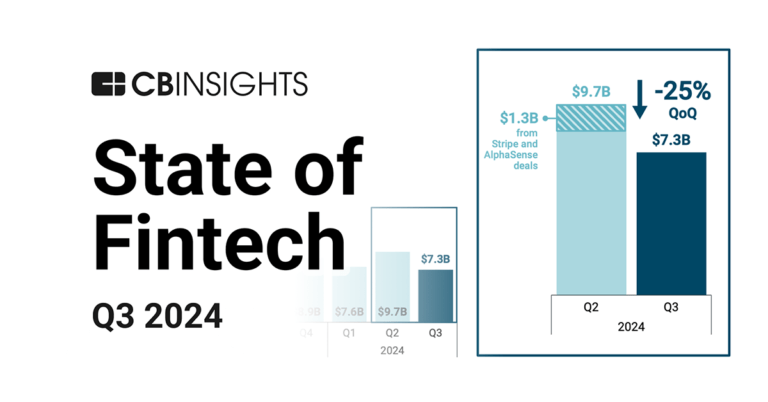

Oct 15, 2024 report

State of Fintech Q3’24 Report

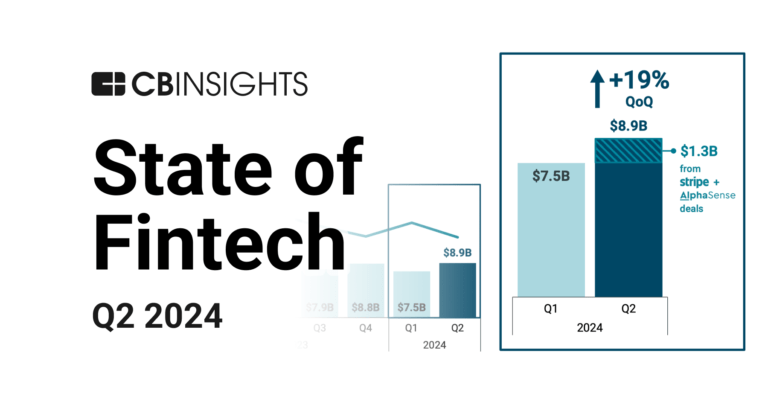

Jul 16, 2024 report

State of Fintech Q2’24 Report

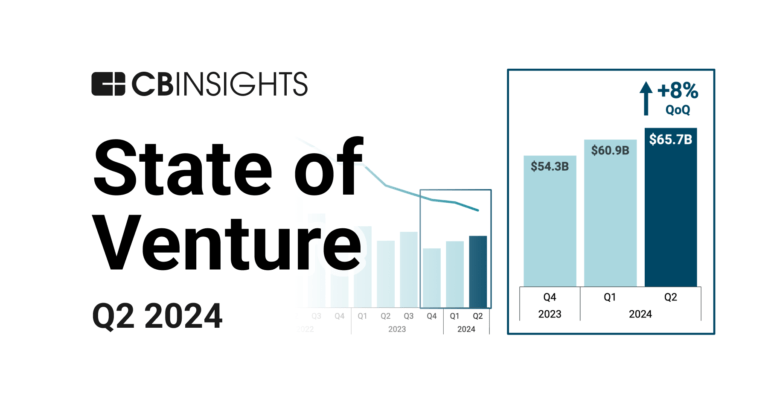

Jul 3, 2024 report

State of Venture Q2’24 Report

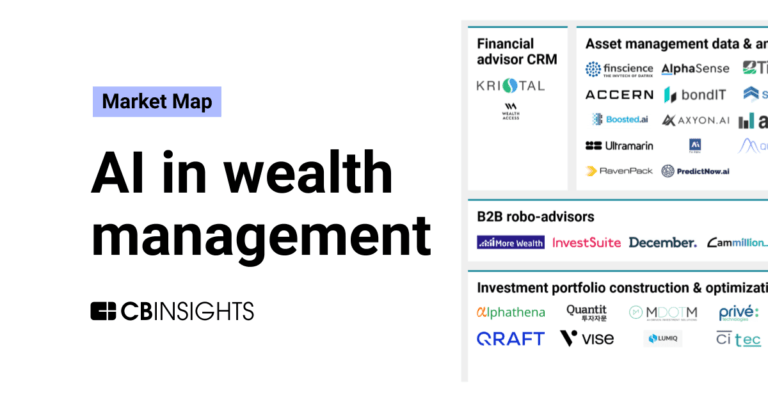

Oct 6, 2023

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing AlphaSense

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AlphaSense is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,049 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

10,049 items

AlphaSense Patents

AlphaSense has filed 37 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/20/2024 | 3/11/2025 | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres | Grant |

Application Date | 9/20/2024 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres |

Status | Grant |

Latest AlphaSense News

Jun 24, 2025

NEW YORK June 24, 2025 /PRNewswire/ -- AlphaSense , the AI platform redefining market intelligence for the business and financial world, today announced the launch of a new data residency region based in the European Union. This strategic investment underscores AlphaSense's commitment to serving the complex needs of enterprise clients across Europe – especially those in Investment Banking, Hedge Funds, Asset Management, and Private Equity. The expansion directly responds to growing demand from financial institutions and corporations that require strict adherence to data privacy and security standards. With the new EU data region, AlphaSense enables customers to meet GDPR compliance and ensures sensitive, proprietary information remains securely within EU borders. This announcement comes amid record growth for AlphaSense's Enterprise Intelligence offering , which has more than doubled its customer base with rapid expansion across key verticals such as financial services, life sciences, industrials, and technology. As market volatility intensifies and decision cycles compress, the world's leading companies are turning to AlphaSense as their Enterprise Intelligence layer – unifying premium business and financial content and internal data to drive faster, more confident decisions. The AlphaSense Enterprise Intelligence platform enables organizations to centralize and act on mission-critical insights from both internal and external sources – transforming fragmented, siloed information into intelligence at scale. By unifying proprietary content with the world's largest premium content library of 500 million documents and powering it through purpose-built Generative AI, AlphaSense delivers unmatched precision and speed. "Launching our EU-based data residency is more than a technical milestone. It's a reflection of our deep, long-term commitment to privacy, compliance, and trust," said Stephen Lynch , EVP & GM of Enterprise Business at AlphaSense. "As the leading AI-native market intelligence platform trusted by the world's largest financial institutions and enterprises, safeguarding customers' proprietary insights is non-negotiable. This offering helps ensure that EU-based enterprises can fully harness AlphaSense's end-to-end intelligence platform – across premium market content and proprietary data – with the confidence that their information remains encrypted, isolated, and compliant with GDPR and local data residency requirements. This is another step forward in delivering secure, high-impact AI for business and financial decision-makers across the globe." With the launch of the new data residency region, AlphaSense is delivering its full suite of secure, AI workflows entirely within the European Union. All customer data remains fully contained in-region, ensuring end-to-end compliance with GDPR and the strictest local data sovereignty standards. Unlike generic AI tools, AlphaSense's AI is purpose-built for business and finance. The platform delivers unmatched accuracy, depth and relevance across high-stakes workflows like earnings analysis, competitive intelligence, corporate strategy, and investor relations. Beyond external content, AlphaSense integrates proprietary data to break down silos – giving companies a unified, secure view of institutional knowledge and market intelligence in one platform. "As European enterprises continue to embrace AI to power critical business decisions, AI platforms that remove friction by helping them also meet the highest standards of security, performance, and compliance are essential," said Lynch. "AlphaSense's AI is designed with these requirements in mind and now, it is delivered on infrastructure purpose-built for the region." About AlphaSense AlphaSense is the AI platform redefining market intelligence and workflow orchestration, trusted by thousands of leading organizations to drive faster, more confident decisions in business and finance. The platform combines domain specific AI with a vast content universe of over 500 million premium business documents — including equity research, earnings calls, expert interviews, filings, news, and internal proprietary content. Purpose-built for speed, accuracy, and enterprise-grade security, AlphaSense helps teams extract critical insights, uncover market-moving trends, and automate complex workflows with high quality outputs. With AI solutions like Generative Search, Generative Grid, and Deep Research, AlphaSense delivers the clarity and depth professionals need to navigate complexity and obtain accurate, real-time information quickly. For more information, visit www.alpha-sense.com Media Contact Remi Duhé for AlphaSense Email: media@alpha-sense.com View original content to download multimedia: https://www.prnewswire.com/news-releases/alphasense-launches-eu-data-residency-region-to-help-ensure-gdpr-compliance-and-data-sovereignty-for-enterprise-intelligence-customers-302489598.html SOURCE AlphaSense Back | Next story: Open Wing Alliance: Undercover Footage Links Retail Giant to Abusive Supplier in Mexico

AlphaSense Frequently Asked Questions (FAQ)

When was AlphaSense founded?

AlphaSense was founded in 2011.

Where is AlphaSense's headquarters?

AlphaSense's headquarters is located at 24 Union Square East, New York.

What is AlphaSense's latest funding round?

AlphaSense's latest funding round is Biz Plan Competition.

How much did AlphaSense raise?

AlphaSense raised a total of $1.397B.

Who are the investors of AlphaSense?

Investors of AlphaSense include Fast Company’s Next Big Things in Tech, Viking Global Investors, CapitalG, Goldman Sachs, J.P. Morgan Asset Management and 34 more.

Who are AlphaSense's competitors?

Competitors of AlphaSense include Rogo, Street Context, Auquan, Reflexivity, Hebbia and 7 more.

What products does AlphaSense offer?

AlphaSense's products include AlphaSense Core Search (newest release: AlphaSense X) and 3 more.

Loading...

Compare AlphaSense to Competitors

Wokelo provides an investment research platform operating in the financial services sector. The company focuses on research workflows such as due diligence, sector research, and portfolio monitoring, using its proprietary large language model (LLM) based agents for data curation, synthesis, and triangulation. It serves private equity funds, investment banks, consulting firms, and corporates, assisting them in making informed decisions. It was founded in 2022 and is based in Seattle, Washington.

YCharts operates as a financial research and proposal platform within the financial services industry. The company provides inclusive data, visualization tools, and analytics for equity, mutual fund, and exchange-traded fund (ETF) data and analysis, enabling investment professionals to improve client engagements and simplify complex financial topics. YCharts primarily serves the financial advisory and asset management sectors. It was founded in 2009 and is based in Chicago, Illinois.

280First is a financial services platform that analyzes unstructured data to provide insights for investment professionals. The company offers a platform that helps investment professionals identify opportunities and manage risks in financial documents. This platform supports investment professionals in managing a broader portfolio of companies. It is based in Redwood City, California.

ProSights provides enterprise AI solutions for the financial services sector, focusing on automating and securing financial workflows. The company offers tools for the extraction, generation, and management of financial documents and data, while addressing data security and compliance for financial institutions. It was founded in 2024 and is based in San Francisco, California.

Canoe Intelligence provides alternative investment data management within the financial technology sector. The company offers cloud-based solutions that facilitate document collection, data extraction, and data science initiatives, allowing financial institutions to process complex investment documents. Canoe's technology is utilized by institutional investors, asset servicers, capital allocators, and wealth managers to manage their data workflows. It was founded in 2017 and is based in New York, New York.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

Loading...