Airwallex

Founded Year

2015Stage

Secondary Market | AliveTotal Raised

$1.052BLast Raised

$150M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+16 points in the past 30 days

About Airwallex

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services, including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Loading...

ESPs containing Airwallex

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

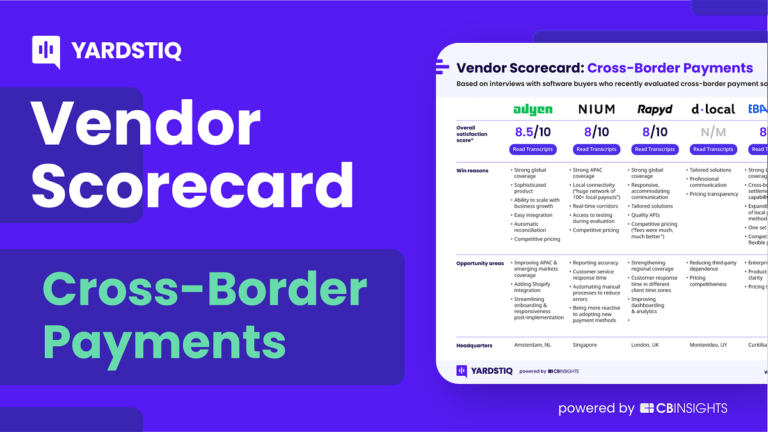

The enterprise cross-border payments platforms market enables businesses to send and collect payments globally. This market offers currency exchange solutions to help monitor exchange rates and hedge currency risk. Many companies offer specialized solutions tailored to various industries, in addition to providing consumer-specific solutions.

Airwallex named as Leader among 15 other companies, including Payoneer, Wise, and Flywire.

Airwallex's Products & Differentiators

SME

Our multi-currency payments platform helps small and medium-sized enterprises (SMEs) move money around the world quickly, affordably, and safely. With this platform, SMEs can send and receive funds in multiple currencies through Airwallex’s online platform or bank transfer, settle in a number of currencies, hold their funds in their Airwallex Global Account, and reconcile expenses, create online payment links that are connected to their account, or spend directly through a Airwallex Borderless Card.

Loading...

Research containing Airwallex

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Airwallex in 9 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

The SMB fintech market map

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose themExpert Collections containing Airwallex

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Airwallex is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,648 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Future Unicorns 2019

50 items

Fintech

13,978 items

Excludes US-based companies

Latest Airwallex News

Jul 9, 2025

The numbers don’t add up. On the surface, Australia’s startup scene looks like it’s stalling. According to Cut Through Venture’s Q2 2025 Quarterly Report , the quarter marked one of the weakest funding periods in over two years. Just one company, payments unicorn Airwallex, secured a raise over $100 million. Larger deals ($50M+) dropped to a two-year low, and overall deal volume slumped. After three consecutive quarters of growth, it looked like the venture market had hit a wall. But a closer look at the data tells a more nuanced story that challenges assumptions about what really fuels a resilient startup ecosystem. While American entrepreneurs are finding it harder than ever to graduate from seed funding to their crucial Series A rounds, Australian startups are quietly outperforming their Silicon Valley counterparts. From Q3 2021 to Q1 2024, Australian companies have beaten US peers in seed-to-Series A transition rates in nine out of 11 quarters, a remarkable consistency that suggests something fundamental has shifted in the Australian market. “The professionalization of the Australian VC ecosystem since 2020 has been extraordinary,” explains one senior investor who spoke on condition of anonymity. “We’re seeing increased interest from overseas funds in Series A opportunities here, and that’s creating a dynamic that’s actually more favorable for early-stage companies than what we’re seeing in the US.” The secret, according to industry insiders, lies in understanding the rhythm of Australian venture capital. Unlike the US market, where startups often have multiple shots at raising subsequent rounds, Australian companies face a more compressed timeline, but one that’s proving surprisingly effective. The data shows that timing is everything: startups that don’t secure their Series A within 24 months of seed funding face steeply declining chances of success. This constraint, rather than being a weakness, appears to be forcing Australian entrepreneurs to be more focused and efficient in their approach. “There’s less room for error here, but that’s actually creating better companies,” says one venture partner. “Australian startups are learning to be more capital-efficient and more focused on real metrics rather than vanity metrics.” The overseas factor Perhaps most intriguingly, the Australian ecosystem’s strength is being partly driven by foreign interest. International funds are increasingly viewing Australia as an attractive Series A hunting ground—a place where they can find companies that have already proven their model in a competitive domestic market but are still relatively undervalued compared to their US equivalents. This overseas attention is creating what economists call a “positive feedback loop.” As more international funds participate in Series A rounds, it validates the Australian market, which in turn attracts even more overseas interest. Yet none of this changes the harsh reality of Q2 2025. With only eight companies raising over $20 million, compared to what sources describe as a “flurry” of mega-deals in Q1: the funding environment has undeniably tightened. The drought of large deals is particularly striking. Beyond Airwallex’s mega-round, only one other company managed to raise above $50 million. This represents a dramatic shift from the more optimistic funding environment of early 2025. “We’re seeing a return to investor caution,” explains one fund manager. “LPs [limited partners] are being more selective, and that’s filtering down to deal-making. But interestingly, this seems to be affecting later-stage deals more than early-stage ones.” Sector winners and losers The funding freeze hasn’t affected all sectors equally. Fintech has roared back to claim the top spot with $2.677 billion raised across just eight deals demonstrating that when Australian fintech companies do raise, they raise big. Climate tech has emerged as a consistent performer, claiming a top-five position for five straight quarters with $135 million across seven deals. Perhaps most notably, AI and big data has broken into the top five most-funded sectors for the first time, with $70 million across six deals. “The sector rotation we’re seeing reflects both global trends and Australia’s particular strengths,” notes one analyst. “We’re not just following global patterns, we’re developing our own areas of competitive advantage.” What’s particularly striking about the Australian performance is its consistency. While the US market has experienced more dramatic swings—both up and down—the Australian ecosystem has maintained a steadier trajectory in seed-to-Series A transitions. This resilience may reflect the smaller scale of the Australian market, which creates both constraints and opportunities. With fewer companies competing for attention, successful startups can build stronger relationships with investors. The flip side is that failures are more visible and can have broader ecosystem impacts. Despite the Q2 slowdown, investor sentiment remains surprisingly optimistic. According to survey data from 115 anonymous VC firms, angel syndicates, and family offices, 78% of investors reviewed more opportunities in Q2 than in Q1, and over half expect to do more deals in 2025. This optimism suggests that the current funding pause may be more of a correction than a collapse. “We’re seeing a flight to quality,” explains one venture capitalist. “The bar is higher now, but the companies that clear it are getting strong support.” The lesson from Australia’s VC paradox may be that success in venture capital isn’t just about the total amount of money in the system: it’s about how efficiently that money is deployed and how well the ecosystem supports companies through their critical early transitions. For Australian entrepreneurs, the message is clear: while the mega-deals may be harder to come by, the fundamental strengths of the local ecosystem: its professionalization, international appeal, and efficient capital deployment remain intact. In a world where bigger isn’t always better, Australia’s more focused approach to venture capital may be exactly what the global startup ecosystem needs. This story is based on analysis of the Cut Through Quarterly Q2 2025 report Keep up to date with our stories on LinkedIn , Twitter , Facebook and Instagram . What do you think?

Airwallex Frequently Asked Questions (FAQ)

When was Airwallex founded?

Airwallex was founded in 2015.

Where is Airwallex's headquarters?

Airwallex's headquarters is located at 15 William Street, Melbourne.

What is Airwallex's latest funding round?

Airwallex's latest funding round is Secondary Market.

How much did Airwallex raise?

Airwallex raised a total of $1.052B.

Who are the investors of Airwallex?

Investors of Airwallex include Square Peg Capital, Lone Pine Capital, Salesforce Ventures, DST Global, AirTree Ventures and 30 more.

Who are Airwallex's competitors?

Competitors of Airwallex include AZA Finance, Verto, Thunes, Zepz, Revolut and 7 more.

What products does Airwallex offer?

Airwallex's products include SME and 2 more.

Who are Airwallex's customers?

Customers of Airwallex include Qantas and Stake.

Loading...

Compare Airwallex to Competitors

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. The company was formerly known as WorldRemit. It was founded in 2021 and is based in London, United Kingdom.

Toss operates as a digital financial platform. It offers a range of financial services, including bank accounts, money transfers, a financial dashboard, credit score management, customized loans, insurance plans, and multiple investment services. It was founded in 2013 and is based in Seoul, South Korea.

Coins.ph is a cryptocurrency exchange and digital wallet provider in the financial technology sector. The company offers a platform for buying, selling, and storing various cryptocurrencies, as well as services for utility bill payments and mobile load purchases. Coins.ph primarily serves individual users and businesses looking to engage with digital assets and cryptocurrency trading. It was founded in 2014 and is based in Pasig City, Philippines. Coins.ph operates as a subsidiary of Wei Zhou.

MoMo specializes in digital payment solutions and super application development. The company offers a comprehensive ecosystem that allows users to perform various daily activities through their platform, as well as leveraging data analytics and AI to enhance user experience and merchant services. MoMo's products cater to various sectors, including financial services, e-commerce, and more. It was founded in 2007 and is based in Ho Chi Minh City, Vietnam.

Paga is a mobile money company that focuses on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

Lianlian Pay operates a network of agents in China where consumers can convert cash into mobile-phone minutes. It allows customers to purchase airline tickets, video gaming credits, and utility bills with its network. It was founded in 2003 and is based in Hangzhou, China.

Loading...