AgentSync

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$161.1MLast Raised

$50M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About AgentSync

AgentSync provides insurance compliance software within the financial services sector. The company has tools for producer management, compliance, and onboarding processes for distribution networks for insurers. AgentSync serves the insurance industry, including carriers, agencies, and MGAs. It was founded in 2018 and is based in Denver, Colorado.

Loading...

ESPs containing AgentSync

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance lead management market refers to the software solutions that help insurance companies manage their leads and sales processes. These solutions typically include lead tracking, customer relationship management (CRM), marketing automation, and analytics tools. The market is driven by the need for insurers to streamline their sales processes, improve customer engagement, and increase rev…

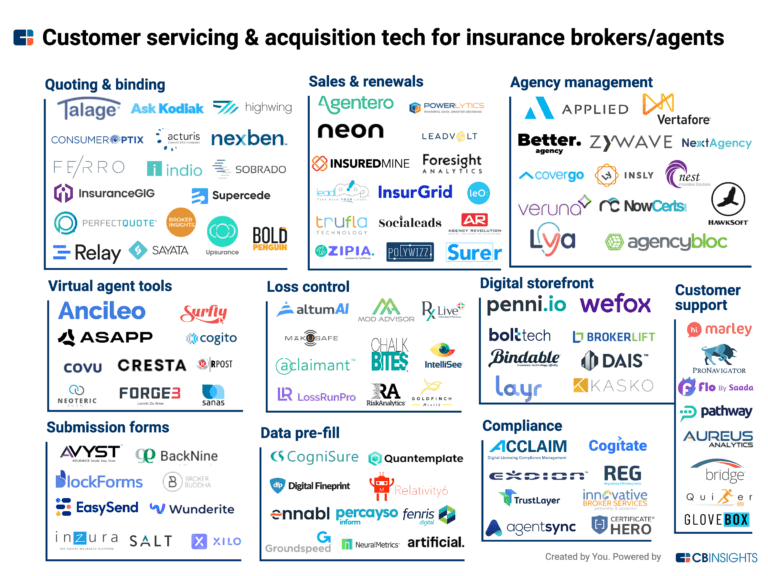

AgentSync named as Leader among 9 other companies, including Better Agency, Applied, and Bridge.

AgentSync's Products & Differentiators

AgentSync Manage

Our core solution, AgentSync Manage, is a powerful platform that effortlessly enforces state producer licensing and appointment regulatory requirements through an integration with the National Insurance Producer Registry (NIPR). Manage minimizes compliance costs and prevents regulatory violations before they occur by automating the administrative paper chase required to verify that agents have the necessary appointments and state licenses to sell. By simplifying the complexity of selling insurance, you can drastically reduce costs and compliance risks associated with manually managing these tasks via spreadsheets and disparate legacy systems.

Loading...

Research containing AgentSync

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AgentSync in 1 CB Insights research brief, most recently on Sep 30, 2022.

Expert Collections containing AgentSync

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AgentSync is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Insurtech

3,347 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest AgentSync News

Jul 8, 2025

If you're in the insurance industry, the answer is that they're all guaranteed to trigger weather and disaster claims from those with P&C insurance like home, business, and auto coverage. For carriers and adjuster firms, a mass-claims event activates an emergency response amongst your administrative staff. This could involve deploying a tsunami of adjusters to an affected state or region. Whether these are staff adjusters or independent adjuster contractors brought on for a single emergency response, onboarding and license compliance are critical to processing claims in a timely manner. Why do insurance carriers have to process claims quickly? Many states—particularly those with robust weather disaster cycles—have specific timeline requirements for insurance carriers to process claims. Insurers that want to sort the wheat from the chaff of legitimate vs. fraudulent or padded claims need to act fast. There are a number of reasons insurance carriers want to be quick to the scene in the aftermath of a natural disaster or weather event such as a hurricane or wildfire: The law. Legally, most states have set timelines of days or weeks for processing and paying “clean claims,” or claims that are clearly covered by the policy and have all relevant data available. We stand by following the law. Speed equals satisfaction Clients with faster claims resolution and response times scored their insurers as more satisfactory. In a word-of-mouth industry like insurance, getting adjusters on the ground to file and process claims quickly is key to growing and retaining business. Like a crime scene, evidence deteriorates over time. Adjusters are your eyes on the ground to spot insurance fraud and determine what qualifies as a legitimate claim. If an adjuster can't check out a claim site for days, weeks, or even months, then sussing out fraud gets a lot harder. When unaddressed, damages (and corresponding claim amounts) can rise . Consider a retiree whose shingles blow off the house in a storm. The damage is covered, and the insurer agrees to fix the roof. But the insurer decides to contract exclusively with a preferred roofer instead of paying out the claim for an outside vendor. The carrier-preferred roofer has multiple storm-related claims in the area, and takes a while to get to the retiree's roof. Meanwhile, each subsequent drizzle or storm pours more onto the exposed roof. Even with tarps, trickling water begins to cause damage inside the home. Now the insurer has to pay to replace a ceiling in a bathroom in addition to the roof. (See how this can spiral?) The longer you wait, the longer schemers and scammers have to move in . Nature abhors a vacuum. So does your dog. And so does insurance. In the wake of a natural disaster, if you don't act quickly to connect with your affected customers, there's more opportunity for some scammer with a generic “file your claim” scheme to befuddle your policyholders. How does adjuster licensing affect claims processing? Without enough adjusters whose licenses are fully compliant and up-to-date in relevant states, your claims-adjusting process will get dragged down, no question. You may be thinking, “Surely that's what all the apps and AIs are for, right? I've seen a million instant-claims-filing app advertisements on the Facebook, so, speedy claims problem SOLVED.” Unfortunately, many claims aren't “clean,” and thus human adjusters with their human need for licensing have to get involved, either by being physically on site or by virtually handling the claims process via photos, videos, and other digital data gathering. Problem decidedly not solved. Similar to insurance producers, insurance adjusters have to maintain licenses in most states, with continuing education and license renewals and the whole shebang. For P&C insurers that are handling this manually, a natural disaster may also equal a paperwork disaster. Maybe you assign an adjuster to a set of claims only to realize they aren't appropriately licensed for that state, or they don't have a designated home state. Then you have to reassign the adjuster, and find a stand-in to meet the customers' needs. Churning adjusters either because of insurer staff attrition or because they are inappropriately licensed is so common that Louisiana introduced a law to prohibit insurers from churning more than three adjusters through a claim assignment within a certain period. According to then–Louisiana Commissioner of Insurance Jim Donelon, the rule “addresses the most-frequent concern raised in the 4,000 complaints [the Louisiana Department of Insurance] received from consumers in the aftermath of Ida.” Turns out, insurance consumers don't like getting handed off to multiple adjusters any more than insurance carriers like finding and replacing them. Speed dating is just not an attractive business model for any angle of the insurance industry. Right now, a lot of carriers and adjuster firms are relying on manual processes that use self-reported information from adjusters. It's a gas-and-brakes game of compliance management while also trying to have enough staff to work the phones in the aftermath of a disaster. But imagine doing business differently. Imagine knowing where an adjuster is licensed and authorized to do business—no ifs, ands, or buts—and being able to correctly route claims accordingly. Imagine connecting to a new adjuster and knowing the first day of the relationship which states they can work in or get a reciprocal license for. How much could the frenzy of adjuster assignments be reduced? How to ramp your adjuster onboarding for the best speed-to-claim P&C claims processing is cyclical—sometimes you can't find enough people to take phone calls, and other times the whole staff can take a long lunch. Staying compliant while you ramp up for a disaster season is easier said than done, and we all know Mother Nature doesn't wait for insurers to dot i's and cross t's With AgentSync Manage, carriers can onboard adjusters in as little as hours, and give carrier and adjuster firms the assurance that their adjusters are up-to-date on licensing, and licensed in the states they need. Instead of scrambling for background checks, license verification, and other required documentation, Manage can provide a single portal for adjuster self-servicing, and integrates easily with digital background check providers. When having a licensed adjuster is critical to a speedy, compliant, and fraud-free claims process—which in turn delivers for the bottom line—it just won't do to have manual errors and spreadsheet tracking slow you down. Offboarding those adjusters when disaster season is over can also be a pain point when you use manual processes. But, with AgentSync Manage's automations and integrations, you can set adjuster licenses to “inactive” status and kick off workflows to email a legal notice to an adjuster when you've terminated their contract. At AgentSync, we can help you lock down your adjusters' licensing and compliance requirements so you can reduce churn and increase your team and customer satisfaction. See how check out our Solutions page Was this article valuable? Regina Stephenson Regina Stephenson is a writer and editor concentrating on the financial services industry, most specifically insurance and insurtech. Since insurance regulation and legislation already make for dry tinder, Regina specializes in setting it alight with blogs that inform and entertain the compliance and operations teams of insurance agencies, carriers, and MGAs alike. By taking an inside-the-community approach to compliance news, her witty exposure of changing regulations and the inflection points of insurance technology keep the insurance industry current. Her previous experiences include ghostwriting and publishing books for independent financial professionals and serving as an online editor at CJOnline.com. Regina enjoys breaking down complex topics into bite-sized, understandable pieces, and is passionate about good storytelling. Outside of her professional work, you can find Regina parenting four kids alongside husband Adam, waging war on the chaos of their fixer-upper bungalow, or reading and watching fantasy escapist stories. More From Author

AgentSync Frequently Asked Questions (FAQ)

When was AgentSync founded?

AgentSync was founded in 2018.

Where is AgentSync's headquarters?

AgentSync's headquarters is located at 3601 Walnut Street, Denver.

What is AgentSync's latest funding round?

AgentSync's latest funding round is Series B - II.

How much did AgentSync raise?

AgentSync raised a total of $161.1M.

Who are the investors of AgentSync?

Investors of AgentSync include Craft Ventures, Valor Equity Partners, Anthemis, Tiger Global Management, Atreides Management and 9 more.

Who are AgentSync's competitors?

Competitors of AgentSync include Rhoads Online Institute and 5 more.

What products does AgentSync offer?

AgentSync's products include AgentSync Manage and 1 more.

Who are AgentSync's customers?

Customers of AgentSync include Senior Life and Online Medicare Distributor.

Loading...

Compare AgentSync to Competitors

RegEd operates as a market-leading provider of Regulatory Technology solutions within the financial services industry. The company offers a suite of enterprise solutions that include workflow-directed processes, regulatory intelligence, automated validations, and compliance dashboards to facilitate operational efficiency and regulatory compliance. RegEd primarily serves the financial services sector, with a focus on compliance and risk management for enterprise clients. It was founded in 2000 and is based in Morrisville, North Carolina.

Spyder specializes in data management, cyber compliance, and secure document storage for the financial services and insurance domains. The company offers a platform that helps in data management and compliance with cyber regulations and document storage needs, tailored specifically for insurance agents and financial service providers. Its solutions are designed to support licensed individuals and home office firms in managing licensing renewals, continuing education, and cyber security certifications. The company was founded in 2021 and is based in Fort Scott, Kansas.

Egnyte provides services in content collaboration and governance within the cloud content management sector. The company offers a platform that enables collaboration, intelligence for content insights, and governance to address cyber threats and ensure data compliance. Egnyte provides solutions for industries including architecture, engineering, construction, operations, life sciences, and financial services. It was founded in 2007 and is based in Mountain View, California.

Advocate provides a software platform to replace manual insurance review processes with automated solutions for lenders in the financial services industry. The platform aims to improve pre-closing and servicing functions. Advocate serves commercial real estate lenders and other financial institutions involved in loan programs. It was founded in 2020 and is based in New York, New York.

CaseWare specializes in cloud-enabled audit, financial reporting, and data analytics solutions for various sectors within the accounting industry. The company provides tools that automate and streamline financial reporting, tax engagements, practice management, and audit processes to enhance efficiency and insights. It was founded in 1988 and is based in Toronto, Canada.

EverCheck is a company that focuses on healthcare compliance, operating within the healthcare and software industries. The company offers automated compliance software that provides services such as license verification, sanction and exclusion management, and continuing education tracking for healthcare professionals. The primary sectors EverCheck caters to are the healthcare and human resources industries. It was founded in 2012 and is based in Jacksonville, Florida.

Loading...