Addepar

Founded Year

2009Stage

Series G | AliveTotal Raised

$743.93MValuation

$0000Last Raised

$230M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+139 points in the past 30 days

About Addepar

Addepar focuses on investment portfolio management within the financial services industry. The company provides a system that consolidates and evaluates data related to market and clients, aiding investment professionals in decision-making. Addepar's services are relevant to wealth managers, family offices, private banks, and institutions, offering functionalities for trading, rebalancing, scenario modeling, and billing. It was founded in 2009 and is based in Mountain View, California.

Loading...

Addepar's Product Videos

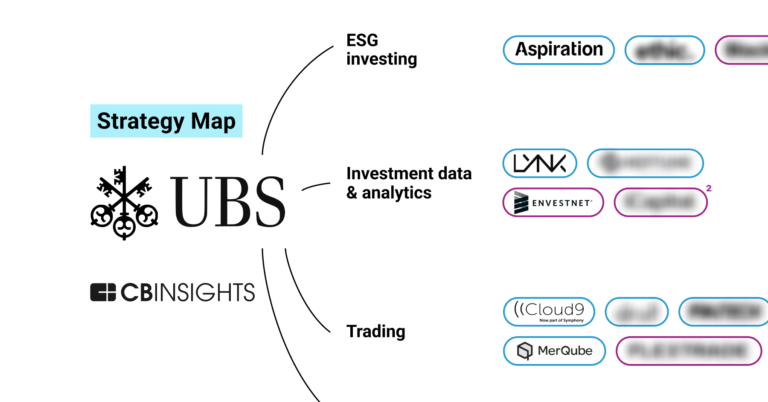

ESPs containing Addepar

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The investment portfolio construction & optimization market uses data-driven algorithms and analytics to help financial professionals optimize portfolio composition, risk management, and returns. Solutions in this market include robo-advisory platforms, direct indexing tools, and AI-driven portfolio management systems that take into account factors such as asset allocation, risk tolerance, market …

Addepar named as Leader among 14 other companies, including BlackRock, Betterment, and SigFig.

Addepar's Products & Differentiators

Addepar (core platform)

Addepar is a software and data platform purpose-built for professional wealth, investment and asset management firms to deliver outstanding results for their clients. Addepar provides a complete set of portfolio data aggregation, analysis, trading and reporting capabilities built on top of a unique data aggregation model. The platform’s highly scalable and robust APIs integrate with hundreds of Addepar-native and industry-leading products, data providers and service partners to deliver a complete solution for a wide range of firms and use cases.

Loading...

Research containing Addepar

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Addepar in 1 CB Insights research brief, most recently on Jul 6, 2023.

Expert Collections containing Addepar

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Addepar is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Wealth Tech

2,658 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

825 items

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Addepar Patents

Addepar has filed 27 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- user interfaces

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/19/2022 | 11/26/2024 | Data management, Data types, Database management systems, Graph data structures, User interfaces | Grant |

Application Date | 7/19/2022 |

|---|---|

Grant Date | 11/26/2024 |

Title | |

Related Topics | Data management, Data types, Database management systems, Graph data structures, User interfaces |

Status | Grant |

Latest Addepar News

Jun 6, 2025

Cette adoption fait suite à celle de la banque privée américaine, le déploiement dans les îles Anglo-Normandes et au Luxembourg étant prévu dans le courant de l'année. HSBC UK Private Banking est au service de clients nationaux et internationaux très fortunés et fortunés, ainsi que de family offices. En tant que l'une des plus grandes organisations de services bancaires et financiers au monde, HSBC s'engage à offrir une expérience client de qualité supérieure grâce à des solutions numériques de pointe. La plateforme Addepar offre une expérience améliorée en matière de reporting client, avec des aspects complexes tels que les alternatives et l'agrégation des comptes. Les chargés de clientèle et les conseillers en investissement peuvent fournir à leurs clients, en quelques clics, des données de performance sur mesure et des informations complètes sur leurs investissements. En outre, la plateforme peut également agréger les performances des clients qui détiennent des investissements auprès d'autres gestionnaires de patrimoine, ce qui permet aux clients d'avoir une vue d'ensemble de leur portefeuille d'investissement. Charles Boulton , responsable du Private Banking, HSBC UK , déclare : « Nous sommes ravis d'adopter la plateforme logicielle de gestion de patrimoine d'Addepar. Il est essentiel pour nos clients de disposer de rapports personnalisés en temps réel pour tous les types d'actifs. La plateforme d'Addepar permettra à nos clients de disposer des meilleures informations possibles pour gérer un écosystème financier de plus en plus complexe. Le fait de pouvoir présenter à un client l'ensemble de son portefeuille afin qu'il ait une vision globale de son patrimoine dans plusieurs monnaies et auprès de plusieurs gestionnaires de patrimoine constituera un grand pas en avant pour nous ». James Thomson , responsable du conseil en investissement, HSBC UK Private Banking , déclare : « En tant que leader dans le domaine des alternatives, avec de plus en plus de clients de la banque privée souhaitant avoir une proportion de leur portefeuille dans cette classe d'actifs, les capacités avancées d'Addepar en matière de reporting sur les produits alternatifs ont été un argument de vente important. Grâce à nos nouvelles capacités de reporting, nos conseillers en investissement pourront fournir à nos clients des informations plus approfondies et une plus grande transparence de manière plus efficace, ce qui leur permettra de consacrer plus de temps à ce qui compte le plus : fournir à nos clients des conseils de haute qualité appuyés par des analyses robustes .» Eric Poirier , CEO d'Addepar , déclare : « Addepar a vocation à apporter plus de transparence, de connectivité et d'intelligence à l'écosystème mondial de l'investissement. L'adoption de notre plateforme par HSBC UK Private Banking reflète exactement ce type de leadership avant-gardiste, avec l'adoption d'une solution conçue pour permettre aux investisseurs, aux conseillers et à leurs clients de disposer d'une perspective complète et opportune basée sur des données pour naviguer en toute confiance dans la complexité avec des informations exploitables. En tant que première grande banque partenaire au Royaume-Uni, HSBC redéfinit ce que cela signifie de diriger avec des données et d'offrir des expériences client vraiment différenciées ». À propos de HSBC UK : HSBC UK sert plus de 15 millions de clients actifs dans tout le Royaume-Uni, avec l'aide de 23 900 collègues. HSBC UK propose une gamme complète de services bancaires de détail et de gestion de patrimoine aux particuliers et aux clients de private banking, ainsi que des services bancaires commerciaux aux petites et moyennes entreprises et aux grandes sociétés. HSBC UK est une banque cantonnée et une filiale à 100 % de HSBC Holdings plc. HSBC Holdings plc, la société mère de HSBC, a son siège à Londres. HSBC sert des clients dans le monde entier à partir de ses bureaux situés dans 58 pays et territoires. Avec des actifs de 3 017 milliards USD au 31 décembre 2024, HSBC est l'une des plus grandes organisations de services bancaires et financiers au monde. À propos de HSBC Global Private Banking HSBC Global Private Banking aide ses clients à gérer, faire fructifier et préserver leur patrimoine pour les générations à venir. Son réseau d'experts internationaux aide les clients à accéder à des opportunités d'investissement dans le monde entier, à planifier l'avenir grâce à la planification du patrimoine et de la succession, à gérer leur portefeuille à l'aide de solutions sur mesure et à trouver le soutien adéquat pour leur philanthropie. www.privatebanking.hsbc.com À propos d'Addepar Addepar est une société mondiale de technologie et de données qui aide les professionnels de l'investissement à fournir à leurs clients les conseils les plus éclairés et les plus précis. Au cours des dix dernières années, des centaines de milliers d'utilisateurs ont confié à Addepar le soin de prendre des décisions d'investissement plus judicieuses et de leur prodiguer de meilleurs conseils. Avec des clients présents dans plus de 50 pays, la plateforme d'Addepar rassemble des données sur les portefeuilles, les marchés et les clients pour plus de 7 000 milliards de dollars d'actifs. La plateforme ouverte d'Addepar s'intègre à plus de 100 partenaires de logiciels, de données et de services pour offrir une solution complète à un large éventail d'entreprises et de cas d'utilisation. Addepar adopte un modèle de personnel flexible à l'échelle mondiale avec des bureaux dans la Silicon Valley, à New York , à Salt Lake City , à Chicago , à Londres, à Édimbourg, à Pune et à Dubaï. This News is brought to you by Qube Mark , your trusted source for the latest updates and insights in marketing technology. Stay tuned for more groundbreaking innovations in the world of technology. PR Newswire PR Newswire empowers communicators to identify and engage with key influencers, craft and distribute meaningful stories, and measure the financial impact of their efforts. Cision is a leading global provider of earned media software and services to public relations and marketing communications professionals. Your experience on this site will be improved by allowing cookies Cookie Policy

Addepar Frequently Asked Questions (FAQ)

When was Addepar founded?

Addepar was founded in 2009.

Where is Addepar's headquarters?

Addepar's headquarters is located at 787 Castro Street, Mountain View.

What is Addepar's latest funding round?

Addepar's latest funding round is Series G.

How much did Addepar raise?

Addepar raised a total of $743.93M.

Who are the investors of Addepar?

Investors of Addepar include 8VC, Valor Equity Partners, WestCap, Vitruvian Partners, EDBI and 21 more.

Who are Addepar's competitors?

Competitors of Addepar include FINNY AI, Flanks, Qplix, PureFacts, Powder and 7 more.

What products does Addepar offer?

Addepar's products include Addepar (core platform) and 4 more.

Who are Addepar's customers?

Customers of Addepar include RBC Wealth Management – U.S..

Loading...

Compare Addepar to Competitors

FINNY AI provides tools for financial advisors to assist in their prospecting efforts within the financial services industry. The company offers services that include identifying potential prospects, prioritizing them based on a compatibility score, and automating outreach processes to support advisor-client connections. Its platform aims to improve the prospecting process, allowing financial advisors to focus on building relationships and developing their businesses. The company was founded in 2023 and is based in New York, New York.

Powder provides artificial intelligence (AI) solutions for the wealth management sector, focusing on document analysis. The company offers AI agents that automate the parsing and analysis of financial documents, which reduces the time required for these tasks and allows wealth management professionals to engage with clients and perform other activities. Powder's AI technology aims to improve client service by increasing productivity, ensuring compliance, and providing data security. It was founded in 2023 and is based in Los Altos, California.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

InvestCloud focuses on transforming the financial industry's approach to digital and operates within the financial technology sector. The company offers a no-code software platform for digital and commerce enablement, providing cloud-native, multi-tenanted solutions that help banks, wealth managers, and asset managers overcome technology debt and meet the needs of their clients. The company primarily serves the financial industry. It was founded in 2010 and is based in West Hollywood, California.

d1g1t provides an enterprise wealth management platform in the financial technology sector. The company offers a comprehensive suite of analytics and risk management tools designed to enhance the quality of financial advice and streamline wealth management operations. Its services cater to financial advisory firms, multi-family offices, registered investment advisors (RIAs), broker-dealers, and bank advisor networks, aiming to integrate various aspects of wealth management into a cohesive system. It was founded in 2017 and is based in Toronto, Canada.

BridgeFT focuses on wealth technology (WealthTech) infrastructure. It provides services within the financial technology sector. The company offers a WealthTech-as-a-Service platform that includes financial data aggregation, advanced analytics, and applications essential for wealth management. BridgeFT primarily serves FinTech companies, registered investment advisors (RIAs), turnkey asset management platforms (TAMPs), and other financial institutions. It was founded in 2015 and is based in Chicago, Illinois.

Loading...