Acorns

Founded Year

2012Stage

Series F | AliveTotal Raised

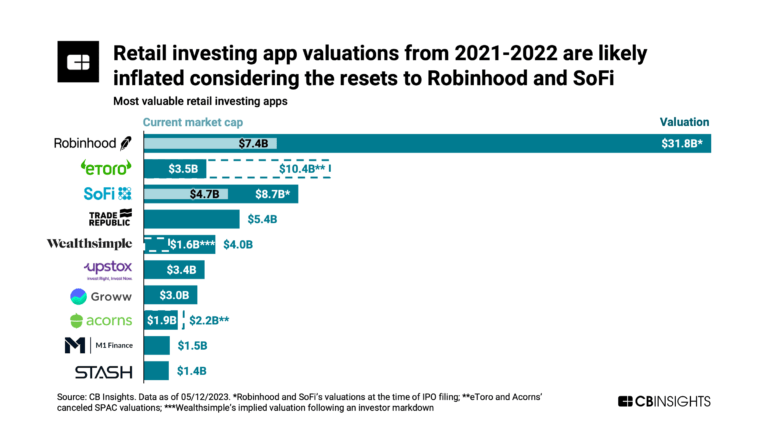

$564.02MValuation

$0000Last Raised

$300M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+31 points in the past 30 days

About Acorns

Acorns focuses on microinvesting in the financial services industry. It offers services that allow customers to invest spare change from everyday purchases into a diversified portfolio of index funds. It primarily sells to individuals looking to start investing in small amounts. The company was founded in 2012 and is based in Irvine, California.

Loading...

ESPs containing Acorns

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital financial wellness market consists of fintechs that deliver combinations of financial products, including banking, investing, loans, and P&C insurance, as well as planning tools such as goals-based planning, account aggregation, asset allocation, and budgeting tools. These companies often have B2C and B2B2C distribution models. While digital financial wellness companies may offer compl…

Acorns named as Challenger among 15 other companies, including SoFi, Revolut, and MoneyLion.

Loading...

Research containing Acorns

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Acorns in 2 CB Insights research briefs, most recently on Aug 30, 2024.

Aug 30, 2024

The financial planning market mapExpert Collections containing Acorns

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Acorns is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Wealth Tech

2,424 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

747 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Acorns Patents

Acorns has filed 27 patents.

The 3 most popular patent topics include:

- financial markets

- investment

- payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/25/2022 | 9/10/2024 | Payment systems, Transaction processing, Payment service providers, Financial markets, Investment | Grant |

Application Date | 4/25/2022 |

|---|---|

Grant Date | 9/10/2024 |

Title | |

Related Topics | Payment systems, Transaction processing, Payment service providers, Financial markets, Investment |

Status | Grant |

Latest Acorns News

Jul 3, 2025

Robo-advisor Market to grow from USD 10.07 Billion in 2025 to USD 79.65 Billion by 2033, at a strong CAGR of 29.51% through the forecast period. ” — Global Growth Insights PUNE, MAHARASHTRA, INDIA, July 3, 2025 / EINPresswire.com / -- Global Robo-advisor Market Report: Growth, Expansion, and Strategic Insights (2025–2033) The Global Robo-advisor Market Report (2025–2033) presents a detailed analysis of the evolving market landscape, highlighting growth trends, market size, segmentation opportunities, key product launches, and geographic expansion strategies. This comprehensive report enables businesses, investors, and industry leaders to make data-backed decisions and navigate market complexities with confidence. What's the Current & Future Size of the Robo-advisor Market? The Robo-advisor Market is set to witness impressive growth throughout the forecast period. Robo-advisor Market to grow from USD 10.07 Billion in 2025 to USD 79.65 Billion by 2033, at a strong CAGR of 29.51% through the forecast period. With rising demand for cutting-edge and efficient solutions, coupled with advancements in product development and technology integration, the market is positioned for exponential expansion. By 2033, the Robo-advisor Market is expected to reach a multi-million-dollar valuation, recording a healthy compound annual growth rate (CAGR) from 2025 to 2033. This reflects strong momentum and significant investment potential across regions and categories. Key Insights from the Report Include: Market segmentation by category and application Revenue growth and sales performance Product innovation and development trends Strategic expansion and regional analysis Risk mitigation and competitive intelligence Download Sample Report Now: https://www.globalgrowthinsights.com/enquiry/request-sample-pdf/robo-advisor-market-101915 Detailed Robo-advisor Market Segmentation A thorough segmentation analysis of the Robo-advisor Market helps uncover targeted growth opportunities and strategic entry points across product categories, applications, and manufacturing trends. Here's a breakdown of the segmentation: Product Type Analysis The Robo-advisor Market is segmented by product type, each tailored to meet specific operational or consumer needs. These segments are witnessing increased demand based on performance, innovation, and usability. Pure Robo Advisors, Hybrid Robo Advisors: This product category continues to dominate the market due to its wide-ranging application, efficiency, and adaptability across industries. It is projected to grow at a strong pace, supported by rising usage in industrial and commercial environments. Application Scope Different end-use applications are driving the adoption of Robo-advisor Market products, particularly where performance, compliance, and sustainability are key decision factors. Retail Investor, High Net Worth Individuals (HNI), Others: This segment represents a substantial portion of the market, attributed to increased demand in high-performance and scalable solutions. Expansion in this area is further reinforced by emerging consumer and industrial trends. Manufacturer Data Insights Key manufacturers in the Robo-advisor Market are leveraging advanced technologies, production capabilities, and regional expansion strategies to boost their market share. Manufacturer data includes: Production Volume & Capacity Utilization Sales Revenue & Operating Margins R&D Investment Trends Supply Chain & Distribution Channel Analytics Product Portfolio Diversification Geographic Presence and Export Trends These insights help stakeholders benchmark market players, identify competitive advantages, and evaluate market positioning. Key Market Players in the Robo-advisor Industry Major players actively shaping the Robo-advisor Market include: M1 Holdings Inc., Acorns Grow, Inc., Betterment Holdings, Inc., Blooom, Inc., SigFig Wealth Management, LLC, Wealthfront, Inc., The Vanguard Group, Personal Capital Corporation, Charles Schwab Corporation, FutureAdvisor by BlackRock and other influential companies driving innovation and market share. The report offers in-depth profiles, including: Sales volume and value analysis Business performance metrics Strategic initiatives and market positioning Leading Regions Driving the Robo-advisor Market The Robo-advisor Market is geographically diverse, with significant contributions from: North America – United States, Canada, Mexico Europe – Germany, UK, France, Italy, Russia, Turkey Asia-Pacific – China, Japan, India, Korea, Southeast Asia South America – Brazil, Argentina, Colombia Middle East & Africa – UAE, Saudi Arabia, South Africa, Egypt These regions are leading due to high consumption, rapid industrialization, and increased adoption of innovative technologies. Browse Detailed Summary of Research Report with TOC: https://www.globalgrowthinsights.com/market-reports/toc/robo-advisor-market-101915 What Are Your Main Data Sources? The report is compiled using a blend of both primary and secondary data sources to ensure comprehensive and reliable insights. Primary data is gathered through in-depth interviews with key industry stakeholders and decision-makers. These include front-line professionals, directors, CEOs, marketing executives, downstream distributors, and end-users, offering firsthand perspectives on market dynamics. Secondary data involves extensive research of publicly available sources such as annual and financial reports of leading companies, official publications, industry journals, and government documents. Additionally, we leverage credible third-party databases to enhance the accuracy of our analysis. A detailed breakdown of the data sources and methodologies can be found across the following chapters: Examination of global Robo-advisor market consumption (value) by region, product type, and application. Identification and analysis of the market structure through segmentation. Evaluation of key global Robo-advisor manufacturers, including market share, competitive landscape, SWOT analysis, Porter's Five Forces, and strategic development plans. Assessment of individual growth trends and their contribution to the broader market outlook. Analysis of the key growth drivers, opportunities, industry-specific risks, and challenges. Forecasting of Robo-advisor submarket consumption across major regions and countries. Tracking of competitive developments such as expansions, agreements, product launches, and mergers & acquisitions. Strategic profiling of leading market players, along with a comprehensive review of their growth strategies. Purchase this Report (Price 3370 USD for a Single-User License): https://www.globalgrowthinsights.com/checkout-page/101915 Explore More Industry Reports Soy Protein Isolate and Rapeseed Protein Isolate Market Market Share by Region: https://www.globalgrowthinsights.com/market-reports/soy-protein-isolate-and-rapeseed-protein-isolate-market-103876 Dimethylvinylchlorosilane Market Market Demand Forecast: https://www.globalgrowthinsights.com/market-reports/dimethylvinylchlorosilane-market-103877 Electric Switchboard Market Industry Insights & Analysis: https://www.globalgrowthinsights.com/market-reports/electric-switchboard-market-103878 Flake Graphite Market Competitive Landscape: https://www.globalgrowthinsights.com/market-reports/flake-graphite-market-103879 Platinum based Cancer Drug Market Market Growth Opportunities: https://www.globalgrowthinsights.com/market-reports/platinum-based-cancer-drug-market-104036 Zinc Pyrithione Market Industry Revenue Trends: https://www.globalgrowthinsights.com/market-reports/zinc-pyrithione-market-104037 Stainless Steel Pickling and Passivation Paste Market Market Expansion Strategies: https://www.globalgrowthinsights.com/market-reports/stainless-steel-pickling-and-passivation-paste-market-104038 Aluminum Trusses Market Industry Future Outlook: https://www.globalgrowthinsights.com/market-reports/aluminum-trusses-market-104039 Isononyl Alcohol Market Market Size Analysis: https://www.globalgrowthinsights.com/market-reports/isononyl-alcohol-market-104040 Metal Sputtering Target Market Industry Trends 2025: https://www.globalgrowthinsights.com/market-reports/metal-sputtering-target-market-104041 About Global Growth Insights market insights: Global Growth Insights is an upscale platform to help key personnel in the business world in strategizing and taking visionary decisions based on facts and figures derived from in-depth market research. We are one of the top report resellers in the market, dedicated to bringing you an ingenious concoction of data parameters. Contact Us: Global Growth Insights Web: www.globalgrowthinsights.com Email: sales@globalgrowthinsights.com Phone: US: +1 (888) 690-5999 / UK: +44 8083 023308 Eric Jones Global Growth Insights email us here Visit us on social media: LinkedIn Instagram Facebook YouTube X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Acorns Frequently Asked Questions (FAQ)

When was Acorns founded?

Acorns was founded in 2012.

Where is Acorns's headquarters?

Acorns's headquarters is located at 5300 California Avenue, Irvine.

What is Acorns's latest funding round?

Acorns's latest funding round is Series F.

How much did Acorns raise?

Acorns raised a total of $564.02M.

Who are the investors of Acorns?

Investors of Acorns include Headline, Greycroft, Bain Capital Ventures, BlackRock, TPG and 30 more.

Who are Acorns's competitors?

Competitors of Acorns include Electus Education, Stash, Varo, ONE, Moneybox and 7 more.

Loading...

Compare Acorns to Competitors

Stash serves as a personal finance app that provides tools for budgeting, stock rewards, and saving for immediate needs and retirement. StashWorks is a workplace benefit that offers education, savings contributions, and rewards for reaching financial goals. Stash was formerly known as Collective Returns. It was founded in 2015 and is based in New York, New York.

Bundil operates as a crypto investment mobile platform. It allows users to automatically invest spare change from everyday credit or debit card purchases into Bitcoin and other cryptocurrencies. It was founded in 2017 and is based in Dallas, Texas.

Changed is a financial technology company that focuses on helping individuals accelerate their debt repayment and achieve financial freedom. The company offers an application-based platform that rounds up users' spare change from everyday transactions and applies it toward their debt, in addition to providing tools for automated payments, tracking loan balances, and setting financial goals. Changed primarily serves individuals looking to pay off personal loans, student loans, auto loans, credit cards, and mortgages more efficiently. It was founded in 2017 and is based in Chicago, Illinois.

Cred provides a personalized investment portfolio tool that matches a client's existing worldview and long-term investing needs. It was founded in 2017 and is based in Tel Aviv, Israel.

Wealthfront specializes in wealth management and robo-advisory services. The company offers automated investing portfolios, cash accounts, and direct stock investing. Wealthfront serves individual investors looking for financial management and investment options. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Empower Finance is a financial technology company that provides credit solutions and financial security tools. The company offers cash advances, a line of credit service called Thrive, and savings features. Empower Finance primarily serves individuals seeking financial products and services. It was founded in 2016 and is based in San Francisco, California.

Loading...